Medicare Initial Enrollment Period

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period .

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

Disenrollment From Your First Medicare Advantage Plan

If you enrolled in a Medicare Advantage plan when you first became eligible for Medicare, you have 12 months to disenroll from the plan and transition back to Original Medicare.

If you dropped a Medicare Supplement Insurance plan to enroll in a Medicare Advantage plan but wish to revert back again, you have 12 months to do so .

Your Plan Changes Its Contract With Medicare

- Medicare takes an official action because of a problem with the plan that affects me.

-

What can I do?

Switch from your Medicare Advantage Plan or Medicare Prescription Drug Plan to another plan.

When?

Your chance to switch is determined by Medicare on a case-by-case basis.

- Medicare ends my plan’s contract.

-

What can I do?

Switch from your Medicare Advantage Plan or Medicare Prescription Drug Plan to another plan.

When?

Your chance to switch starts 2 months before and ends 1 full month after the contract ends.

- My Medicare Advantage Plan, Medicare Prescription Drug Plan, or Medicare Cost Plan’s contract with Medicare isn’t renewed.

-

What can I do?

Join another Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Don’t Miss: Ppo Dental Plans With No Waiting Period

Trial Rights Special Enrollment Period

Seniors have two different types of trial rights special enrollment periods:

- When you are enrolling in a Medicare Advantage plan upon first becoming eligible for Original Medicare. Note: Seniors that started Original Medicare before age 65 or chose to delay it, this does not apply once you turn 65 years of age.

- When you drop a Medicare Supplement plan and are joining a Medicare Advantage plan for the first time but are looking to switch back within a year.

You Have A Chance To Get Other Coverage

- I have a chance to enroll in other coverage offered by my employer or union.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan to enroll in the private plan offered by your employer or union.

When?

Whenever your employer or union allows you to make changes in your plan.

- I have or am enrolling in other drug coverage as good as Medicare prescription drug coverage .

-

What can I do?

Drop your current Medicare Advantage Plan with drug coverage or your Medicare Prescription Drug Plan.

When?

- I enrolled in a Program of All-inclusive Care for the Elderly plan.

-

What can I do?

Drop your current Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Anytime.

Don’t Miss: What Are The Chances Of Getting Pregnant On Your Period

Does Medicare Cover The Costs Of Diabetic Supplies

Yes, Medicare does cover certain supplies if you have diabetes. Part B covered supplies include blood sugar self-testing equipment and supplies, insulin pumps, and therapeutic shoes or inserts. To get Medicare drug coverage, you must join a Medicare prescription drug plan. These plans typically cover insulin, anti-diabetic drugs, and certain diabetes supplies such as syringes and needles. The Medicare Coverage of Diabetes Supplies and Services booklet provides a comprehensive look what diabetes related services are covered.

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Don’t Miss: How Does Birth Control Affect Your Period

How Do I Enroll In A Prescription Drug Plan

The Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans.

For assistance with Part D plan comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for prescription drug plans available in your area.

If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

How Do I Enroll In A Medicare Advantage Plan During My Special Enrollment Period

If you are unsure about whether you qualify for a Medicare Special Enrollment Period, or if you qualify and want to compare plans in your area, you can speak with a licensed insurance agent for help.

A licensed insurance agent can answer any questions you have and help you compare benefits, costs, coverage and other details of Medicare Advantage plans that may be available in your area.

Read Also: How To Deal With Period Cramps Without Medicine

A Medicare Advantage Plan That Surrenders Contracts With Providers

If your Medicare Advantage plan ceases contracts with many of its providers and these terminations are considered substantial, you will be granted a one-time opportunity to switch to a different Medicare Advantage plan.

The period given to make the change will begin the month you are notified of the opportunity and will continue for two months thereafter.

If your circumstances do not fit into any of the Special Enrollment Periods described above, you may ask the Centers for Medicare and Medicaid Services for your own Special Enrollment Period based on your situation.

Contract Violations Or Enrollment Errors

If you are enrolled in a Medicare Advantage plan that failed to provide benefits in accordance with the plans terms or provided misleading information about coverage or other circumstances, you may be given an opportunity to disenroll from or switch to a new Medicare Advantage plan.

The timeframe in which you may do so will depend on the situation.

Read Also: My Period Makes Me Feel Sick And Tired

What If An Employer Gives Me Money To Buy My Own Health Plan

A note about individual coverage: youll qualify for an SEP if you delayed Part B because you had employer-sponsored coverage through a group health plan . This is a specific type of insurance plan sponsored or run by your employer. It includes coverage your employer offers you through an insurer, and plans purchased from the Small Business Health Options Program marketplace.

Instead of offering GHP coverage, some employers provide you money to buy your own health insurance. They can reimburse you directly, in which case the money is taxed, or through a Qualified Small Employer Health Reimbursement Arrangement or an Individual Coverage Health Reimbursement Account . Coverage you buy on your own does not qualify you for the Part B SEP even if an employer paid for some or all of it. If you have individual coverage, you should sign up for Medicare when youre first eligible, and can enroll during your initial enrollment period or the general enrollment period.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh worked on federal and state health insurance exchanges at the technology firm hCentive.

Contributions to healthinsurance.org and medicareresources.org represent only his own views.

Does Medicare Cover The Costs Of Durable Medical Equipment

Medicare does cover durable medical equipment, which is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home. Original Medicare normally pays 80% of the Medicare-approved amount after you meet your Part B deductible and you are responsible for a 20% coinsurance. Medicare only covers durable medical equipment if your provider says it is medically necessary for use in the home. You must also order the equipment from suppliers who contract with Original Medicare or your Medicare Advantage Plan. If you have a Medicare Advantage Plan, your plan will have its own cost and coverage rules for durable medical equipment. For a more comprehensive list of what is covered, please visit Durable Medical Equipment section in the Medicare and You handbook.

Recommended Reading: Is It Possible To Be Pregnant After Your Period

When You Can Enroll For Health Coverage The Best Ways To Do It And How To Avoid Penalties

by Dena Bunis, AARP, Updated December 9, 2022

SDI Productions/Getty Images

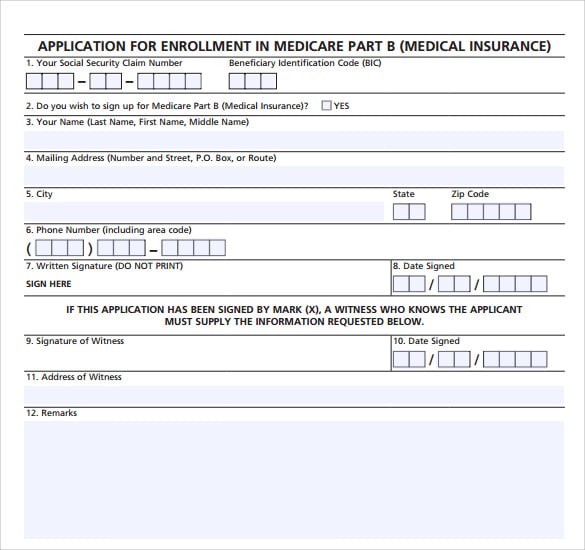

En español | Turning 65 is the trigger point for the vast majority of Americans to enroll in Medicare. Since the Social Security Administration handles enrollments, you will typically sign up at the Social Security office nearest you or online at SSA.gov. Failing to enroll in Medicare on time could cost you, so pay attention to the various enrollment options outlined below to keep from getting hit with a penalty for missing the sign-up window.

Here are the most important things you need to know about when and how to enroll in this federal health insurance program.

Step By Step Instructions For Filling Out This Application

Recommended Reading: Why Do I Bleed A Lot On My Period

Delaying Medicare Due To Work: Special Enrollment Period

If you didn’t enroll in Medicare because you were still working, and you were covered under a group health plan based on employment, you have a Special Enrollment Period during which you can sign up for Part A and/or Part B. While you or your spouse are still working and you’re still covered under a group health plan, you can sign up anytime.

After your or your spouse’s employment ends, your Special Enrollment Period lasts eight months, starting the month after the employment or group health plan ends . You can sign up for Part B anytime during that period and your coverage will begin the month after you sign up .

Special rule for Medicare Advantage or Part D drug plans. You have only two months after the month your employment or group health plan ends to sign up for a Medicare Advantage plan or Part D prescription drug plan . You can enroll in a Medicare Advantage plan starting three months before your Medicare Part B enrollment is due to take effect up to the day before your Part B coverage startsâbut again, enrollment must take place within two months of your employment or group health plan ending.

When coverage begins. If you sign up for Part B while you are still covered by a group health plan, or during the first full month that you no longer have this coverage, your Part B coverage will begin the first day of the month you sign up. But you can choose, instead, to have your coverage begin with any of the following three months.

How Do I Enroll In A Medicare Advantage Plan

Medicare Advantage Plans are health care options provided under Medicare Part C of the Medicare program. These plans are approved by Medicare but sold and serviced by private companies. There are several plan options available under Medicare Advantage such as managed care plans that involve a provider network to those that are specially designed for people with certain chronic diseases and other specialized health needs and some that may or may not have a provider network requirement. Most Medicare Advantage plans include Medicare prescription drug coverage.

For assistance with Medicare Advantage Plans comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for Medicare Advantage Plans available in your area.

To enroll in any Medicare Advantage plan option you must have both Medicare Part A and Medicare Part B. Once you enroll into a Medicare Advantage plan, you will not use your Original Medicare card as your Medicare Advantage plan will replace Original Medicare. Instead the Medicare Advantage plan will provide you with a member ID card to use when visiting your medical provider. Please note, you will continue to pay the Medicare Part B premium, and you might also have to pay an additional monthly premium charged by the Medicare Advantage plan.

Recommended Reading: When Will I Start My Period

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes Part D prescription drug coverage, Medicare Part A hospital insurance and Part B medical insurance combined into a single plan

- Enroll in a Medicare Part D standalone prescription drug plan that can be paired with other insurance such as Original Medicare , Medicare Supplement plans or Medicare Advantage plans that don’t include drug coverage

In 2022, 23.1 million Medicare beneficiaries were enrolled in a standalone Part D Medicare drug plan.3

Learn more about Part D drug coverage. You can also enroll in a prescription drug plan online when you visit MyRxPlans.com.

Medicare Special Enrollment Periods

When using Medicare Special Enrollment Periods, beneficiaries can enroll in Medicare outside of typical Medicare enrollment periods. Because of this, beneficiaries may delay original Medicare enrollment due to creditable coverage or change current Medicare benefits due to a qualifying life event.

Medicare beneficiaries who experience a qualifying life event get a two-month Special Enrollment Period.

Qualifying life events include:

- Moving out of your plans service area

- Moving back to the U.S. after living abroad

- Release from incarceration

- Gaining or losing eligibility for a Special Needs Plan

- Enroll in or leaving the Program of All-Inclusive Care for Elderly

- Your plan stops providing coverage in your area

- You want to enroll in a 5-star plan

- You gain or lose eligibility for Medicaid, Extra Help, or a Medicare Savings plan

- You move into or out of an institutional facility

- You gain or lose eligibility for a qualified State Pharmaceutical Assistance Program

Those who are and choose to delay Medicare benefits due to qualifying creditable coverage get an eight-month Special Enrollment Period. During this time, they can enroll in Original Medicare and can then enroll in a Medicare Supplement plan or Medicare Advantage plan.

When using your Special Enrollment Period to enroll in Medicare Part A, Part B, and Part D, you will not be subject to any penalties. Keep in mind, you only have two months to enroll in a Part D plan while using a Special Enrollment Period.

You May Like: How Long Does A Period Last For

Medicare Supplement Insurance Enrollment

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan , the best time to sign up is during your six-month Medigap Open Enrollment Period.

- Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

- Insurance companies cannot deny you Medigap coverage or charge you a higher fee for pre-existing health conditions if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period.

If you dont sign up for a Medigap plan during your Medigap Open Enrollment Period, you may still be able to buy one at any time.

Insurance companies can take your health into consideration when setting your premiums or deciding whether or not to offer you coverage, however.

You must be enrolled in Medicare Part A and Part B in order to buy a Medigap plan.

Medigap and Medicare Advantage plans are very different, and you cannot be enrolled in a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about the differences between Medicare Advantage vs. Medicare Supplement Insurance.

Request a free, no-obligation Medicare Supplement Insurance quote today by visiting MedicareSupplement.com.